ED’s Corner: ESG – some thoughts on water management and corporate sustainability

We at the WaterPortal are passionate about water. We all know water affects everything. The irony is that it often disappears underground and, for many people is only noticed when there is too much, or too little. Or when its quality is compromised and is, directly or indirectly, affecting our health. At the WaterPortal, we strive to draw water into the foreground and to provide a credible, scientifically based and neutral source that our readers can tap into. (And also, it seems, a flood of damp water jokes and puns…)

As part of our mission, the WaterPortal offers “The Bog” (see, the jokes keep flowing) – an intermittent blog of entries on topics we think are topical and that might whet your curiosity on those topics. Typically, Bog authors to write on their speciality and share their expertise and opinions. This will be the first of an experimental new Bog series on topics which have caught the attention of WaterPortal staff for various reasons and which we think you might find interesting. We’re calling it “Ed’s corner” as we have a new Executive Director (get it?) and this is us dabbling on the shores of blog writing. Please give us feedback on whether you like it or hate it. Or suggest new topics for us to research and write about.

And so, to our first topic…

ESG – some thoughts on water management and corporate sustainability

What is “Environmental, Social and Governance” reporting?

ESG, or “Environmental, Social and Governance”, reporting is a growing trend in corporate governance reporting that includes a wide range of topics which may affect the corporate financial bottom line [i]. In in sign of the prevalence of Canadian ESG reporting, PwC Canada rated ESG reporting across Canada’s top 250 publicly traded companies [ii] in 2022. ESG reporting tends to go far beyond the traditional financial disclosure statements as the following definitions of the ESG components indicates [iii]:

- Environmental

Factors related to emissions, recycling, environmental footprint, environmental stewardship, biodiversity impacts, sustainability, etc. Considered most complex from a reporting perspective. - Social

Factors related to employee management, labour practices, safety of products and services, supply chain health & safety, access to their products and services by the disadvantaged, etc. - Governance

Shareholder rights, board diversity, executive compensation, corruption, etc.

Sounds onerous – why bother?

Essentially, ESG reporting ties into a broad movement towards greater sustainability and corporate transparency. While ESG predates them, the United Nations’ Sustainable Development Goals and the European Union’s Corporative Sustainability Directive [iv, v] are helping drive the movement. Here in Canada, there is a similar proposal from the Canadian Securities Administrator [vi] although more narrowly focused on climate-related reporting and greenhouse gases. There are other relevant entities which exert influence on Canadian sustainability assurance reporting [vii, viii]. It should be noted that ESG reporting is becoming politically contentious in the United States [ix] with some parties promoting active resistance to ESG.

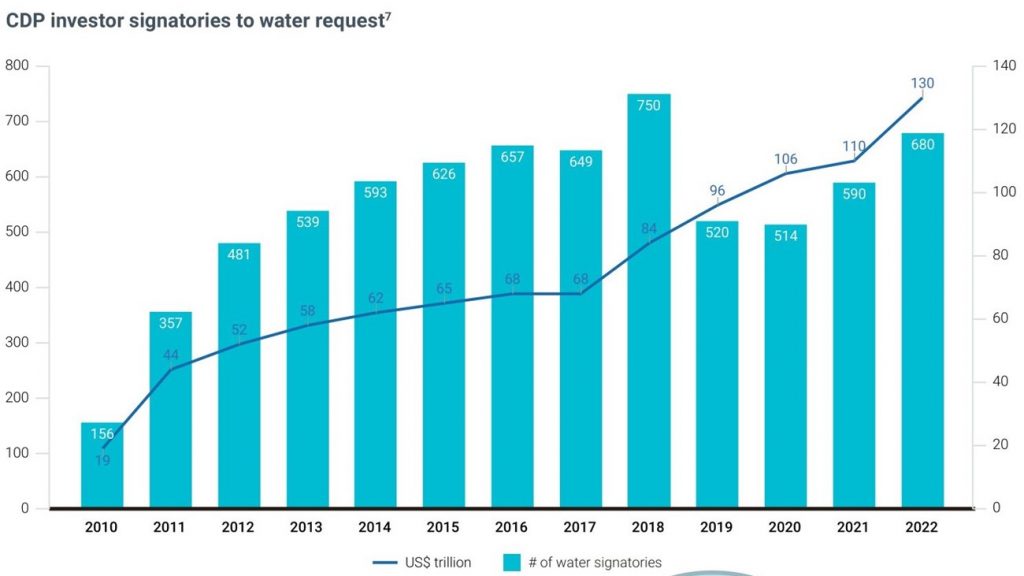

Aside from the regulatory environment, there is also growing interest from investors who are starting to apply ESG-related criteria to their investment decisions and are expecting relevant disclosure from the corporations in which they are prepared to invest. The CDP’s 2022 Global Water Report “Riding the Wave” released in March 2023 [x], notes that investors controlling US$130 trillion are requesting the disclosure of corporate water information (p.6) and the numbers are growing (see Figure 1 below).

Figure 1: Trends of interested investors and their assets

What is the tie to water management?

Environment is the obvious ESG component for the reporting on water issues. In 2021, the World Economic Forum noted that water-focused ESG reporting frameworks were considered, in general, to be under-representing water-related risks and opportunities [xi] with relation to corporate performance. The article cited above calls for water risks to be considered of equal importance as climate risk while understanding that water risks are connected to, but independent of, climate risks.

A lauded exception is the Water Framework of the CDP (previously known as the Carbon Disclosure Project). The CDP is a global non-profit which specializes in environmental effect disclosures by companies and local, regional, and public authorities. The CDP has produced several water-focused reports over the last few years based on the growing number of companies responding to CDP questionnaires. Some of these reports are foundational to the discussion below.

What’s the benefit of reporting on organizational water use?

Water availability and quality are growing issues for organizations. Aside from obvious industries such as agriculture, many industries are starting to realize:

1) how dependent they are on water, and

2) that the dependency should no longer be taken for granted.

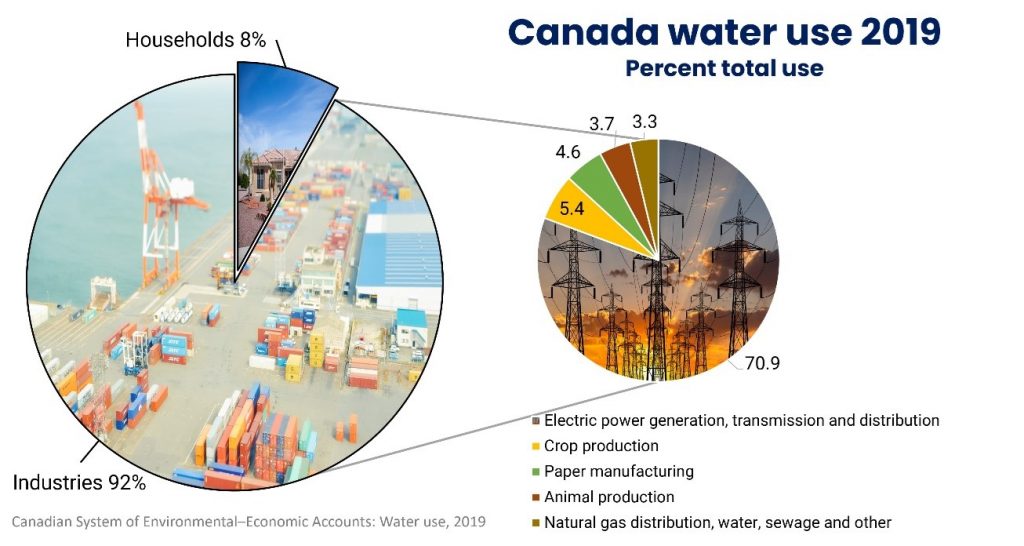

In Canada, Statistics Canada (StatsCan) reports on Canadian water usage: in 2019 [xii], 8% went to household use, 92% went to industrial use. (See figure 2 below.) While the StatsCan report makes no mention of eco-system services and issues such as environmental flow needs, that 92% use suggests that some moderate tweaks in industrial processes could provide significant benefits to both industry and the environment.

Figure 2: Canada’s water use in 2019 as per Statistics Canada, 2022.

The CDP’s 2023 “Riding the Wave” report notes that 3909 companies provided water-related data to the CDP in 2022 (out of 8477 asked). A 2022 CDP report, “High and dry” [xiii], details 4 case studies of major industrial operations being derailed by water issues. Perhaps most relevant for Canadians is the cancellation of the Keystone XL pipeline which, as per the CDP, was significantly driven by community concerns over freshwater contamination. The cancellation is thought to have cost the TC Energy corporation a cumulative CA$5 billion.

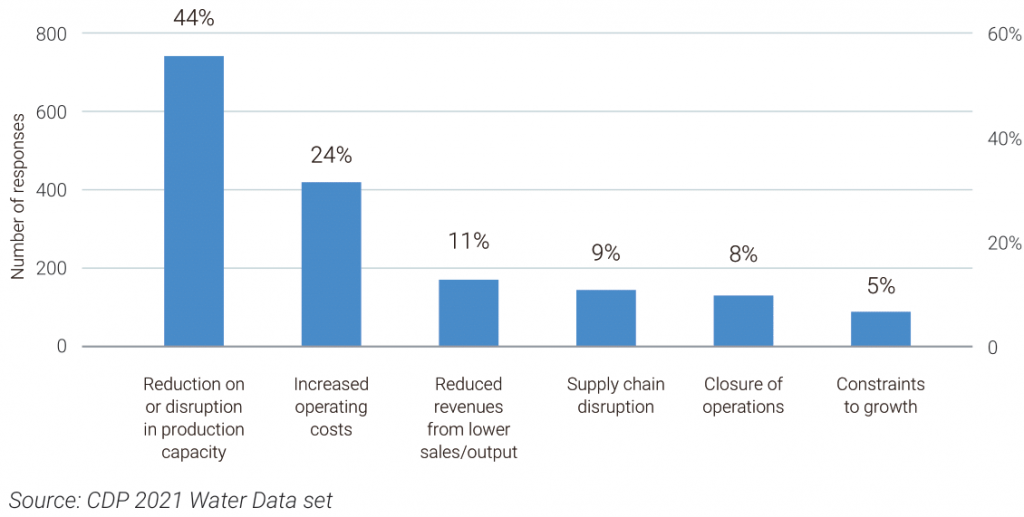

Similarly, Barrick Gold is estimated to have written off US$7.5 billion from the “asset stranding” of the Chilean portion of the Pascua-Lama gold mine as a result of significant water-related concerns. More generally, the CDP’s “High and dry” report indicates the prevalence of global corporate concern (Figure 3 below): 68% of the 1,112 survey respondents expect an estimated maximum impact of US$225 billion from the six water-related risk factors identified in the chart below.

Figure 3: Water-related risk drivers reported by survey respondents

Aside from the “sticks” mentioned above, there are also “carrots”. The CDP’s 2023 “Riding the Wave” reports some key incentives (p.4) identified by their reporting corporations:

- “4x more opportunities” for those firms integrating water into long term business and financial planning.

- The identification of a cumulative US$436 billion in water-related business opportunities.

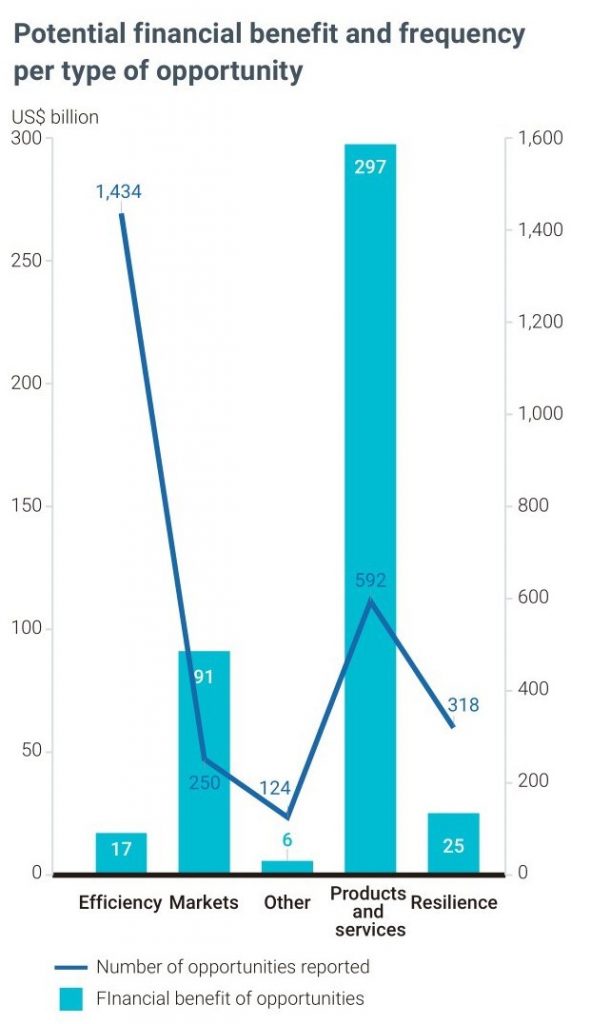

More specifically, 1,729 respondents to the CDP survey reported identifying water-related business opportunities arising from potentially being able to access new markets, increase production capacity, become more resilient, gain competitive advantage and better access to credit (p.12, see Figure 4 below). It is notable that the StatsCan report cited above notes that 2019’s “intensity of industrial water use” was 16.6 cubic metres per CA$1000 of GDP which represents a 6.3% decrease (i.e. improvement from the perspective of water conservation) over 2017. No cause for the decrease is cited beyond a comment that the largest decreases occurred in agrifood production and that 2019 had high levels of precipitation. (Ed’s comment: it would be nice to think that this decrease was also connected to greater efficiency of use – we’ll have to see the next report to see whether a trend is starting. Household use has been trending down since 2009 although 2019 saw a slight increase over 2017 but below the population growth rate [xiv].)

Figure 4: Number and value of water-related opportunities identified by CDP respondents

Summary

As a sweeping summary statement: water reporting under ESG can trigger the corporate attention which reveals both threats (supply, social license) and opportunities (vulnerability reduction, increased efficiency, competitive advantage). Further, explicit attention to water and sustainability may support corporate efforts in building relationships with the communities in which they operate, their investors and their customers. And, while there may not be a direct causal link, it is to be hoped that the greater awareness engendered by ESG reporting will also result in improved water-related environmental outcomes.

Sources

[ii] PwC, 2022, PwC Canada study highlights continued shortcomings in ESG reporting across top 250 public companies. https://www.pwc.com/ca/en/today-s-issues/environmental-social-and-governance/esg-reporting-insights.html. Accessed 2023-05-31.

[iii] Deloitte, n.d., #1: What is ESG? https://www2.deloitte.com/ce/en/pages/global-business-services/articles/esg-explained-1-what-is-esg.html. Accessed 2023-05-23.

[iv] Menier, T., Mishkin, S.H. et al, 2023, EU Finalizes ESG Reporting Rules with International Impacts. https://corpgov.law.harvard.edu/2023/01/30/eu-finalizes-esg-reporting-rules-with-international-impacts/. Accessed 2023-05-23.

[v] Wollmert, P. & Hobbs, A., 2022, How the EU’s new sustainability directive is becoming a game changer. https://www.ey.com/en_gl/assurance/how-the-eu-s-new-sustainability-directive-is-becoming-a-game-changer. Accessed 2023-05-24.

[vi] Canadian Securities Administrator, 2021, Consultation Climate-related Disclosure Update and CSA Notice and Request for Comment Proposed National Instrument 51-107 Disclosure of Climate-related Matters. https://www.osc.ca/sites/default/files/2021-10/csa_20211018_51-107_disclosure-update.pdf. Accessed 2023-05-23.

[vii] Yacyshyn, A., 2022, Understanding the changing landscape of sustainability assurance in Canada. https://www.cpacanada.ca/en/business-and-accounting-resources/audit-and-assurance/blog/2022/march/changing-landscape-sustainability-assurance. Accessed 2023-05-23.

[viii] Lamb, C. et al, 2022, Setting the high-water mark for mandatory disclosure. https://cdn.cdp.net/cdp-production/cms/policy_briefings/documents/000/006/409/original/Setting_the_high_water_mark_for_mandatory_disclosure.pdf?1660576398. Accessed 2023-05-23.

[ix] Malone, E., Holland, E. et al, 2023, ESG Battlegrounds: How the States Are Shaping the Regulatory Landscape in the U.S. https://corpgov.law.harvard.edu/2023/03/11/esg-battlegrounds-how-the-states-are-shaping-the-regulatory-landscape-in-the-u-s/. Accessed 2023-05-23.

[x] CDP, 2023, Riding the Wave: How the private sector is seizing opportunities to accelerate progress on water security. https://www.cdp.net/en/research/global-reports/global-water-report-2022. Accessed 2023-05-23.

[xi] Sarni, W., 2021, We need to rethink ESG to ensure access to water and sanitation for all. https://www.weforum.org/agenda/2021/08/rethink-esg-to-ensure-access-to-water-and-sanitation-for-all/. Accessed 2023-05-23.

[xii] Statistics Canada, 2022, Physical flow accounts: Water Use, 2019. https://www150.statcan.gc.ca/n1/pub/11-627-m/11-627-m2022087-eng.htm. Accessed 2023-06-01.

[xiii] CDP, 2022, High and dry: how water issues are stranding assets. https://www.cdp.net/en/research/global-reports/high-and-dry-how-water-issues-are-stranding-assets. Accessed 2023-05-23.

[xiv] Statistics Canada, 2023, Table 38-10-0250-01 Physical flow account for water use (x 1,000). https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=3810025001&cubeTimeFrame.startYear=2009&cubeTimeFrame.endYear=2019&referencePeriods=20090101%2C20190101. Accessed 2023-06-01.