Extreme weather: insurance and government’s financial response

Alberta is no stranger to extreme weather events, such as the 2001-2002 drought and 2013 Southern Alberta flood. However, not all extreme weather events that impact Albertans will make national headlines; events such as intense rain, heavy snow, hailstorms, unseasonable frosts, and drought can have significant consequences for families and communities.

When recovering from extreme weather events, you may not always know where to turn. Sometimes there can seem to be an overwhelming number of resources to consult, while in other cases there can appear to be very few.

To help, we have compiled the potential financial resources available to Albertans as they recover from an extreme weather event involving water: flood, drought, snow and hail. This is by no means an exhaustive summary of the resources, financial or otherwise, which may be available during the extreme weather event recovery period.

Click the following links to learn more about what’s covered at the personal level and how municipal, provincial and federal governments respond:

Personal coverage for extreme weather events

Municipal financial response to extreme weather events

Provincial financial response to extreme weather events

Federal financial response to extreme weather events

Photo: Storm Coming by Roman Cherednychenko [1]

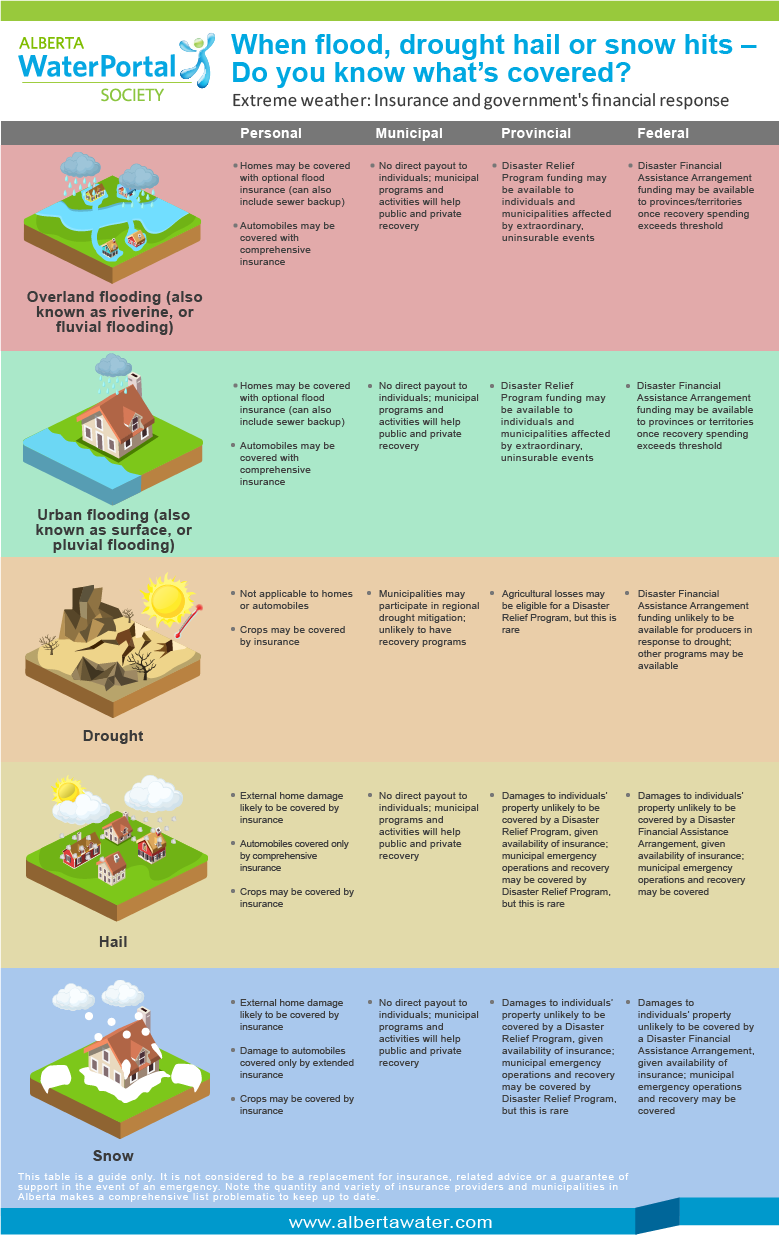

When flood, drought, hail or snow hits – do you know what’s covered?

| Extreme Event | Personal | Municipal | Provincial | Federal |

| Overland flooding (also known as riverine, or fluvial flooding) | Homes may be covered with optional flood insurance (can also include sewer backup)

Automobiles may be covered with comprehensive insurance | No direct payout to individuals; municipal programs and activities will help public and private recovery | Disaster Relief Program funding may be available to individuals and municipalities affected by extraordinary, uninsurable events | Disaster Financial Assistance Arrangement funding may be available to provinces/territories once recovery spending exceeds threshold |

| Urban flooding (also known as surface, or pluvial flooding) | Homes may be covered with optional flood insurance (can also include sewer backup)

Automobiles may be covered with comprehensive insurance | No direct payout to individuals; municipal programs and activities will help public and private recovery | Disaster Relief Program funding may be available to individuals and municipalities affected by extraordinary, uninsurable events | Disaster Financial Assistance Arrangement funding may be available to provinces/territories once recovery spending exceeds threshold |

| Drought | Not applicable to homes or automobiles

Crops may be covered by insurance | Municipalities may participate in regional drought mitigation; unlikely to have recovery programs | Agricultural losses may be eligible for a Disaster Relief Program, but this is rare[2] | Disaster Financial Assistance Arrangement funding unlikely to be available for producers in response to drought[3]; other programs may be available[4] |

| Hail | External home damage likely to be covered by insurance

Automobiles covered only by comprehensive insurance Crops may be covered by insurance | No direct payout to individuals; municipal programs and activities will help public and private recovery | Damages to individuals’ property unlikely to be covered by a Disaster Relief Program, given availability of insurance; municipal emergency operations and recovery may be covered by Disaster Relief Program, but this is rare | Damages to individuals’ property unlikely to be covered by a Disaster Financial Assistance Arrangement, given availability of insurance; municipal emergency operations and recovery may be covered |

| Snow | External home damage likely to be covered by insurance

Damage to automobiles covered only by extended insurance Crops may be covered by insurance | No direct payout to individuals; municipal programs and activities will help public and private recovery | Damages to individuals’ property unlikely to be covered by a Disaster Relief Program, given availability of insurance; municipal emergency operations and recovery may be covered by Disaster Relief Program, but this is rare[5]. | Damages to individuals’ property unlikely to be covered by a Disaster Financial Assistance Arrangement, given availability of insurance; municipal emergency operations and recovery may be covered |

This table is a guide only. It is not considered to be a replacement for insurance, related advice or a guarantee of support in the event of an emergency. Note the quantity and variety of insurance providers and municipalities in Alberta makes a comprehensive list problematic to keep up to date.

Download the above table in this image format

Sources

[1] Retrieved from https://www.flickr.com/photos/glorund/

[2] The Canadian Press. 2015. Alberta’s farming losses from extreme weather declared a ‘disaster’. Retrieved from https://www.theglobeandmail.com/news/national/albertas-farming-losses-from-extreme-weather-declared-a-disaster/article26067865/

[3] Parliamentary Budget Office Request. 2015. Disaster Financial Assistance Arrangements. Retrieved from http://www.pbo-dpb.gc.ca/web/default/files/Documents/Reports/2016/DFAA/DFAA%20disaster%20payments%20EN.pdf

[4] Statistics Canada. 2015. Data quality, concepts and methodology: Explanatory notes on direct program payments to producers. Retrieved from http://www.statcan.gc.ca/pub/21-015-x/2012001/technote-notetech3-eng.htm

[5] Matt Dykstra, Edmonton Sun. 2015. Alberta NDP face criticism after “Snowtember” aid funding denied. Retrieved from http://www.edmontonsun.com/2015/07/30/alberta-ndp-face-criticism-after-snowtember-aid-funding-denied