Six tricky questions about flood insurance in Alberta

Recent significant floods and the predicted increase of extreme weather events have many Albertans, from insurance experts to governments to property owners, talking about flood insurance.

Throughout these conversations the same basic, but tough, questions continue to rise. We don’t know all the answers, but here are the questions as they relate to the current situation and developments.

1. How do you define a flood?

Is a flood a specified volume down the closest river? Overland water only? More than five basements flooded in one community? Groundwater infiltration? When a provincial disaster is declared?

The Insurance Bureau of Canada states that in general, overland flooding resulting in water entering a home is not covered. Overland flooding usually occurs when bodies of water, such as rivers, dams, and other watercourses, overflow onto dry land and cause damage.[1]

There are also differences for insurance between flood damage and water damage.

What is clear is that consensus on the definition of a flood would enable consistency in policy development, education, and coverage levels for the large number of stakeholders impacted by flood insurance including the Alberta public. Once a flood is defined, you can narrow down what can and can’t be covered in the event of damage.

2. Who owns flooding risk?

When floods subside there’s usually plenty of finger pointing on what could’ve been done, who’s responsible, and what needs to be done to avoid the damage of future floods. However, the crux question is who owns the risk?

If we look at an existing house on a floodplain, there were multiple parties involved throughout the steps leading to the development, approval, construction, purchase, insurance, and renovations or other property work. Because there are so many diverse stakeholders and circumstances it’s unlikely there will ever be a single body, or owner, responsible for flood risk (or its management) in Alberta.

So, if there isn’t one owner of the risk, it has to be shared – and how that works is yet another question! Looking around the world it’s common for flood risk to be shared across levels of government, private insurance companies, and individual householders. This would require a strong collaborative and inclusive approach to developing flood risk and management in a province like Alberta.

However there’s more to that challenge, as how people work together is influenced by their own perception of a particular issue. When it comes to risk, in many cases, people’s perception is often to underestimate it.

Programs like Disaster Financial Assistance Arrangements (DFAA) have also impacted people’s perception of risk, building an expectation for some people that someone else, like the government, should cover the costs of their loss. In theory the government has obligations to support the public; however this approach exposes all taxpayers to large costs in the event of a disaster and potentially undermines private insurance efforts.

To revisit the question of who owns flooding risk, there needs to be a balanced distribution of risk between government, private sector, and homeowners. How that could work for Alberta will take some time to develop.

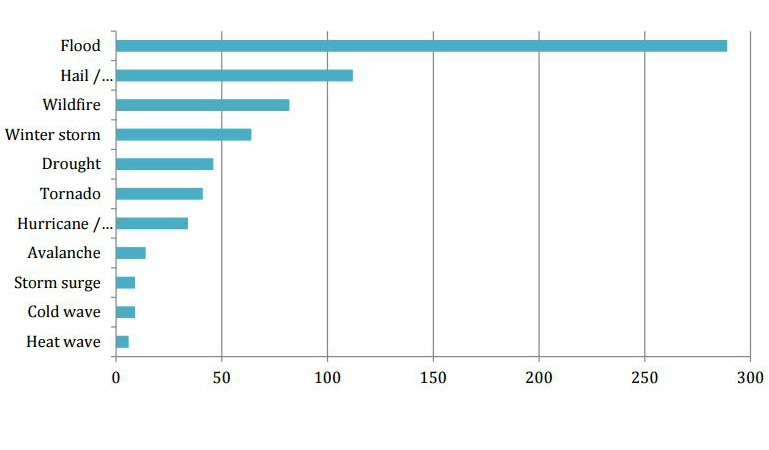

Number of hydrological and meteorological disaster events in Canada (1900-2013)

Source: Canadian Disaster Database

3. How do you cost flooding risk?

After you decide how flooding risk is dispersed, there has to be a common value to disperse it – and that’s usually financial. However, it’s not as easy as divvying up costs. Cheap insurance can reinforce risky choices of where and how to reside. At the other end of the scale, expensive insurance precludes many people who want to cover their property for damages but cannot afford to cover it.

One suggestion is insurance pricing reflects flood mitigation measures that have been invested in. For instance, a province spends millions on flood mitigation, and these investments are captured in insurance premiums.

Another complication for pricing flooding risk is that each region is different, and a broad brush approach to pricing would not be suitable. This requires tools, like updated flood mapping and modelling, to support the suitable pricing of risk across different locations.

Additionally, flood mapping and modelling needs to be adaptable, as changing infrastructure (such as flood mitigation) would have an impact on insurance pricing. This creates an obstacle for insurers and municipalities to overcome on the timely communication of infrastructure changes that may influence insurance premiums.

4. Should the province or the nation lead changes in flood insurance?

Since every provincial assistance program is different, a ‘one size fits all’ approach would be difficult. Also, eliminating programs like the DFAA is not a black and white decision at the federal level, let alone considering provincial implications.

Further, the government can, and has, introduced regulatory prevention strategies (similar to Ontario where development on flood plains is not allowed), but the insurance industry must also be involved heavily in leading the change and educating the public in a clear way on what flood insurance means.

5. What’s being done at the moment?

In Alberta

- Mitigation and prevention strategies are being employed in Alberta, including:

- Infrastructure for flood mitigation

- Flood mapping

- River modelling

- Erosion control

- Legislation to limit development in floodways, and

- Education and public awareness about flooding.

Across Canada

Public Safety Canada is working with the Insurance Bureau of Canada in exploring a ‘Canadian solution’ to the problem of overland flooding. Work is starting up again now the federal election is over.

Public Safety Canada is also collaborating with Environment Canada and Natural Resources Canada to identify national standards on flood mapping. In addition they will be learning from the United Kingdom and Germany to inform Canada’s approach.

A private sector working group has been established for the insurance industry to collaborate on the challenges faced in the development of flood insurance in Canada.

6. What can I do to protect myself now?

We suggest the following resources to get you started:

- Institute for Catastrophic Loss Reduction Booklet for Reducing Basement Flooding.

- Public Safety Canada Floods – What to do?

- If you’re interested in an overview of flood and drought and watershed management in Alberta, view this webinar.

Further information and support may also be available via your local community or municipality. For example in Chestermere (Alberta) a group has formed in response to the July 2015 floods. Their goal is to better understand and respond to some of the emotional impacts of the flood, and to source and provide access to resources to support residents, no matter the level of impact on their lives.

Flood insurance in Alberta won’t be here overnight, but a number of providers are starting to offer overland flooding options for property owners.

Flood insurance is not as simple as offering policies to everyone. Updated flood mapping and risk assessment of flood prone areas, improved land-use planning, public education and awareness, and investments in mitigation are all required as part of an effective approach. By asking simple but hard questions, it’s clear the issue is not just an insurance topic and any approach to changing the situation needs to be an inclusive one.

This blog was informed and inspired by a Stakeholder Discussion – Residential Flood Insurance session, facilitated by Public Safety Canada and the Insurance Bureau of Canada in Calgary earlier this month.